This Acorns review will go over different ways to save with the platform. There are several ways to use the Acorns platform… Acorns Review: Invest, Later, Spend, Earn and Family beginners with low balances seeking the cheapest option. So all-in-all, Acorns might be most useful to people who sorely need a boost in their savings vs.

An investment account’s balance rounds to the nearest dollar when a user makes purchases with a linked account. The robo-advisor features of Acorns make the most sense to investors who like the platform’s “round-up” savings claim. This is due to the lack of human consultants on the platform and high fees with lower investments. So, Acorns may not be the best option if you’re new to investing and have a limited budget. Its flat-fee structure is somewhat more expensive than percentage-based fees for those who are just getting started. However, the platform may be suitable if you’re experienced in investing and have deep pockets. It allows any investor to invest in exchange-traded funds (ETFs). So, let’s jump into the review.Īcorns makes passive investing easy for new investors with its simple platform. As a result, it’s an ideal investing platform for seasoned investors looking to boost their savings. It achieves this with its prebuilt expert portfolios and investing features.

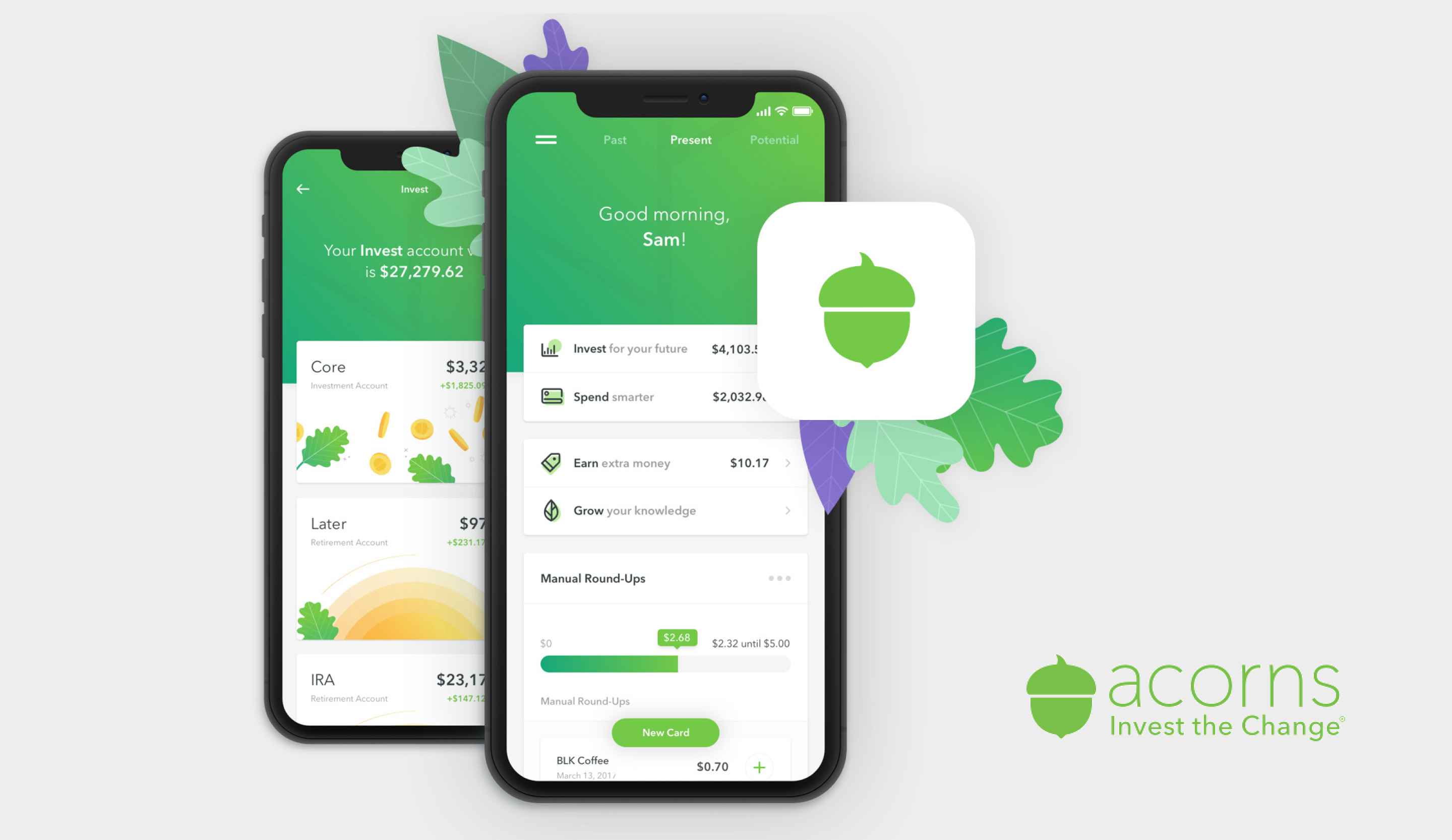

In this Acorns review, we’ll be going over the investment app that allows users to round-up purchases and automatically invest the change into various expert ETF portfolios.

0 kommentar(er)

0 kommentar(er)